Brewing Profit: The Hidden Math Behind Your Latte

A side-by-side look at how Starbucks standardizes profit from Toronto to Manila.

By Kanishka S. for Atlas October

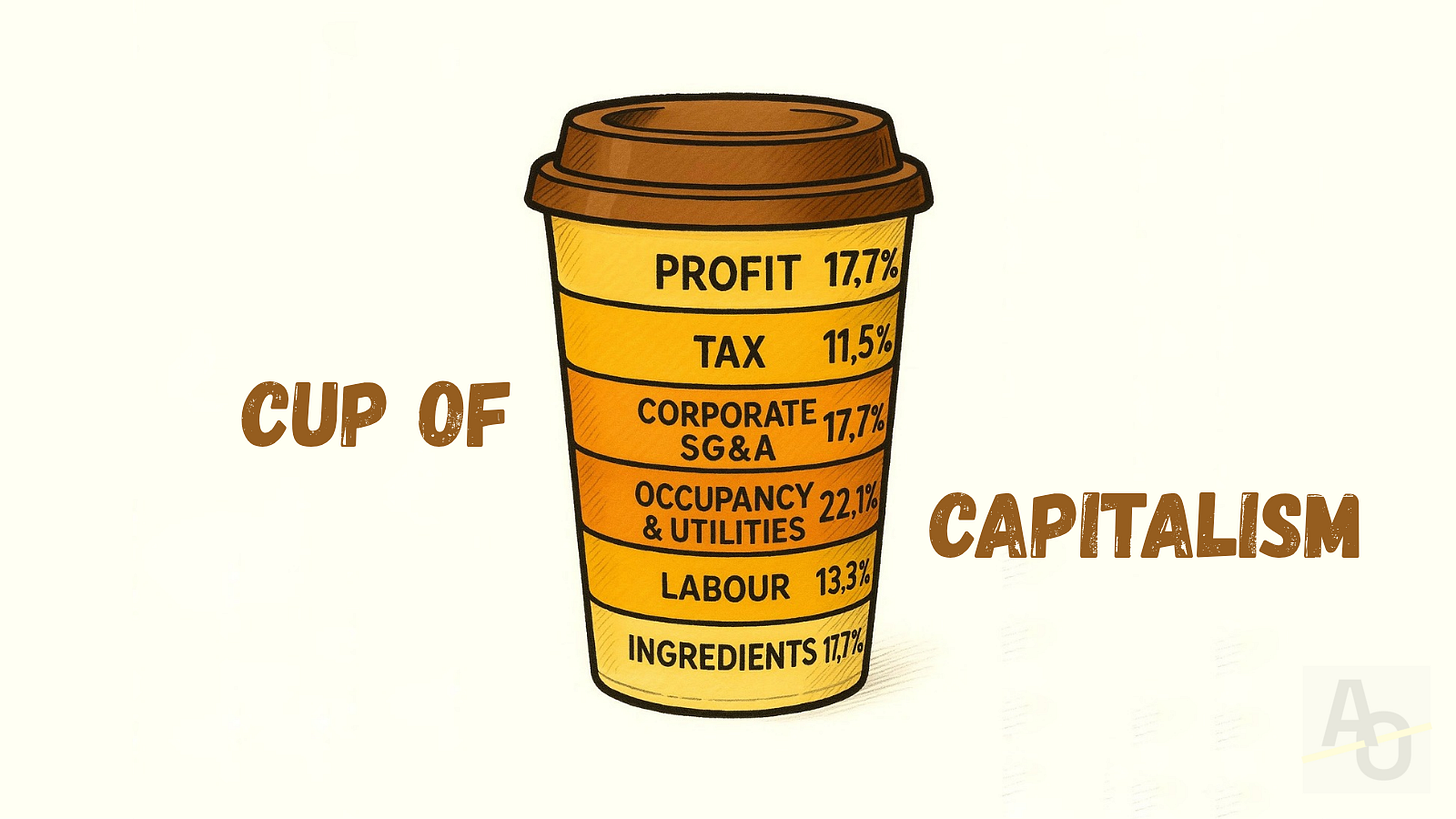

Starbucks and the Art of Global Price Wizardry

Ever wonder why your latte seems suspiciously priced no matter where you sip it? Starbucks has perfected a neat trick: engineering nearly identical profit margins everywhere. Whether you're in Toronto paying over five bucks after tax or in Manila handing over 165 pesos VAT-in, about one-fifth of your cup goes straight to Starbucks' bottom line. Forget costs dictating price; this is pricing engineered backwards from the sweet spot of shareholder satisfaction.

Cheap Labour Doesn't Mean Cheap Coffee

Yes, Filipino baristas earn roughly a fifth of their Canadian counterparts' hourly wage, but your latte isn't similarly discounted. Turns out the wage savings disappear into imported milk, logistics markups, and corporate overheads instead of making their way into your pocket. “Cheap” labour (a problem all in of itself that we’ll explore in a future essay) benefits Starbucks HQ far more clearly than your wallet.

Real Estate: The Ultimate Equalizer

Starbucks loves premium spots and posh stores; and those don't get cheaper just because local salaries do. Rent, utilities, and corporate bureaucracy eat about 40% of your latte's price in both Canada and the Philippines. Prime real estate cares nothing for local wage disparities.

Ingredient Costs: The Real Drama

In Metro Manila, where dairy cows aren’t exactly grazing anywhere nearby, milk alone dominates your latte's ingredient cost. Milk in Canada by comparison is a third less expensive. Geography dictates more of your drink's price tag than you'd ever guess, making supply-chain economics oddly more exciting than you'd assume.

Hidden Taxes, Visible Illusions

Canada adds its HST at checkout, inflating your final ticket at the till. The Philippines quietly buries VAT in the menu price, offering consumers a smoother illusion; even if the tax grab is basically identical. Price perception shaped by subtle tax tricks? Clever move.

Bottom Line?

Starbucks isn't selling coffee; it's selling an economic sleight-of-hand, perfectly calibrated globally. Your latte price isn't about fairness or cost recovery—it's about optimizing the spreadsheet behind the scenes. Welcome to modern capitalism: brewed to perfection over the past century, fresh to order for you daily.

A Peek at My Madness

The numbers aren’t all secrets, it just requires some digging, sorting, and basic maths to sort out. Admittedly some of it needed to be inferences, where public data isn’t available. In every calculation I erred on the side of over estimating costs, so if anything is off, the profit margins get bigger, not smaller. Here’s a summarized version of how I added things up:

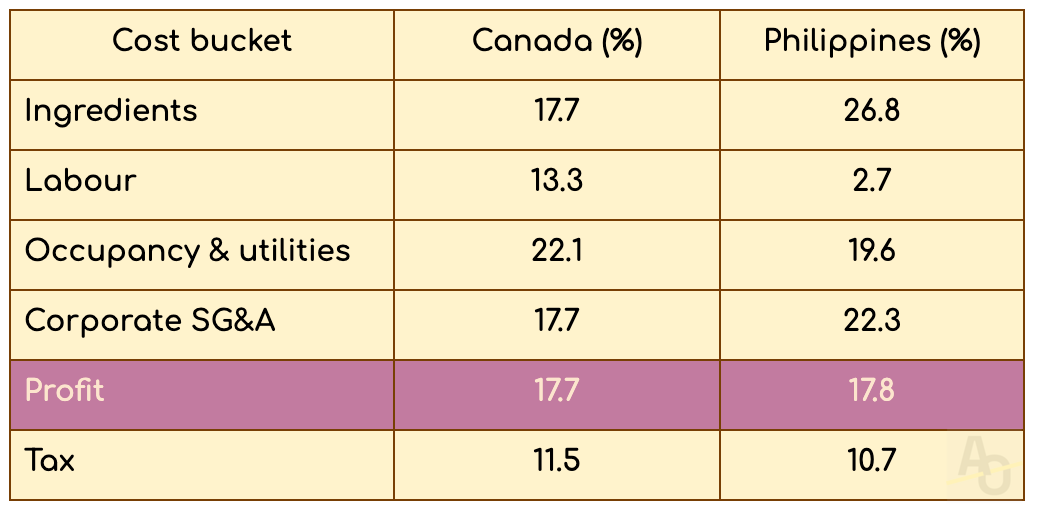

Canada, TORONTO (CA $4.85 + 13% HST → CA $5.48 final ticket)

We started with the pre-tax till price the Toronto store displays (CA $4.85). Sales tax is extra in Ontario, so 13% HST (CA $0.63) is carved out first, giving the tax slice (11.5%). Ingredient cost comes next: 240mL of 2% milk priced at the May-2025 national average (CA $5.38 per 2L ≈ CA $0.73 per latte); 14g of espresso cost CA $0.14 using the ICO composite arabica benchmark of US ¢334 lb (May 2025); the cup/lid/sleeve set is estimated at CA $0.10 from packaging‐supplier quotes. Together they tally CA $0.97, or 17.7% of the CA $5.48 take. Barista labour is derived from the national median wage for NOC 65201 (CA $16/hr) plus a 10 % benefits uplift, then divided by an assumed 27 drinks/hr throughput, yielding CA $0.73 (13.3%). Store occupancy + utilities (22.1%) and corporate SG&A (17.7%) follow Starbucks’ FY-2024 cost ratios, scaled to the final ticket. The residual CA $0.97 (17.7%) is the store-level operating profit.

Philippines, METRO MANILA (ticket ₱165 VAT-in)

The posted Tall Caffè Latte price is ₱170 in most 2025 menus; we used ₱165, the modal Metro-Manila figure and stripped out 12% VAT per BIR regulations. Ingredients dominate because fresh milk is mostly imported: at a retail average of ₱102 L, 240 mL costs ≈ ₱24.5, but café contracts run higher, so we used an upper-bound ₱34; add ₱6 for espresso (same ICO price, freight-adjusted) and ₱5 for cup/lid, totalling ₱45 or 26.8%. Barista pay: PayScale’s 2025 average ₱49.6/hr, grossed up 10%, divided by 20 drinks/hr, gives ₱4.5 (2.7%). Rent, utilities and local distribution run leaner on paper but higher as a share of sales, allocating 19.6% for occupancy and 22.3% for SG&A, mirroring Starbucks’ emerging-market filings. The balancing line; ₱29.4 or 17.8%, is the estimated net profit once everything upstream is paid.

Endnotes

1. Starbucks Canada menu data: Tall Caffè Latte pre-tax price (CA $4.85), 2025

2. Statistics Canada: average retail price for 2 % milk (CA $5.38 / 2 L), May 2025

3. International Coffee Organization: composite arabica coffee price bulletin (US ¢334 / lb), May 2025

4. Packaging supplier industry report: wholesale hot-cup, lid & sleeve cost averages, 2025

5. Government of Canada Job Bank: median hourly wage for baristas (NOC 65201), 2025

6. Starbucks Corporation FY 2024 Annual Report (Form 10-K): store-level operating margins; occupancy & SG\&A allocations

7. Ontario Ministry of Finance: Harmonized Sales Tax (HST) rate of 13 %, 2025

8. Pricemenuguide.ph: Metro-Manila Tall Caffè Latte menu price (₱165), 2025

9. Bureau of Internal Revenue (Philippines): Value-Added Tax rate of 12 %, 2025

10. PayScale: average hourly wage for baristas in the Philippines (₱49.6 / h), 2025

11. Philippines Bureau of Agricultural Statistics: retail dairy price survey (₱102 / L for 2 % milk), April 2025

A peek at your madness = 😵💫

To those who noted that HST (retail sales tax in Ontario) is 13%, you're correct. Which is 11.5% of of the final selling price of a $5.48 latte.

Why Canada (along with the US and a few others) insists on adding tax at the register instead of baking it in into the price, I'll never agree with. That's another maddening deep dive essay topic. Maybe we'll get into it one day.